“Dear Employer

C19 TERS: Temporary Employee / Employer Relief Scheme

Please note the following:

Steps 1:

Key Documents required

- Letter of Authority, on an official company letterhead granting permission to an individual specified to lodge a claim on behalf of the company

- MOA (completion of the agreement between UIF, Bargaining Council and Employer); only applicable to employers that has more than 10 employees

- Prescribed template that will require critical information from the employer

- Evidence/payroll as proof of last three months employee(s) salary(ies)

- Confirmation of bank account details in the form of certified latest bank statement

All documents submitted will be subject to verification.

Step 2:

Submission Process

Submit/transmit all documents as required to UIF via dedicated mailbox

Covid19UIFclaims@labour.gov.za

Step 3:

Conclusion

Conclusion of the MOA between parties.

Payment will only be effected after MOA sign off between the Fund and the Employer/Bargaining Council.

Please complete attachment 6 if the payment must be paid to Employer/Bargaining council

Additional Information

- NMW that will be used to determine minimum payment to employees is as follows:

- Domestic: R124 .56 per day

- Agriculture: R149.44 per day

- EPWP: R91.36 per day

- Other Sectors: R166 .08 per day

- Opening of special account is only applicable to Bargaining council

- If you represent more than one employer, please submit one template per employer

- The means to payment is critical and provide banking details as per the mode selected, for example, if the payment should go to the employer, then the employer special banking account should be given.

- However, proof of payment is required to satisfy that the payments indeed went to the employees. This is also critical, if further payments are required.

- Please note the enquiry telephone to enquire on the claims lodged: 012 337 1997

- With reference to the prescribed template : Please note rules to executed

Payroll Companies: ( Use Attachment 1 and 2 )

- ##Filename should be in the following format

UIREEFERENCENUMBER_ddmmmyyyy_uniquesequence.csv

Example – 00000012_25mar2020_01.csv . unique sequence number can be a number which is not used to send file with same name – so when you send file first time uniquesequence can be 1, when sent second time it can be 2.

- File should start with a Header – H|DATE DDMMMYYYY

COLUMN HEADERS AS UNDER ARE NOT REQUIRED IN THE FILE. ITS JUST TO INDICATE SEQUENCING. REMOVE THE HEADER ONCE FILE IS GENERATED. ONLY H|DDMMMYYYY is required on the Top

UifReferenceNumber|Shutdown From (DD-MMM-YYYY)ONLY|Shutdown Till(DD-MMM-YYYY)ONLY|Trade Name|PAYE number|Contact Number|Email Address|IDNumber|First Name|LastName|Renumeration(Monthly)|Employment Start Date|Employment End Date|Sector Minimum wage per month|Leave Income(During Shutdown)|Bank Name|Branch Code|Account Type|Account Number

- The values of remuneration should not be comma-separated. Example – 26000.90 and not 26,000.92

- All the dates in CSV file should follow the date format DD-MMM-YYYY – Example – 23-APR-2020

- Sector Minimum wage per month value is Mandatory. A blank value will result in an error.

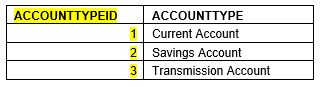

- Account Type value should reflect as below. Please use the Account Type ID instead of Account Type description.

- ## each file should have footer record as under

F|2050, HERE 2050 IS THE NUMBER OF EMPLOYEE RECORDS IN THE FILE

No payroll software. ( Use Attachment 3 )

This format is only for small employer who have no payroll software.

- The values of remuneration should not be comma-separated. Example – 26000.90 (Correct) and not 26,000.92

- All the dates in EXCEL file should follow the date format YYYY/MM/DD – Example – 2020/04/23

- Sector Minimum wage per month value is Mandatory. A blank value will result in error.

- Account Type value should reflect as below. Please use the Account Type ID instead of Account Type description. Use 1 for Current, 2 For Savings and 3 for Transmission Account

Unemployment Insurance Commissioner”

Attachments we received with this email from the Unemployment Insurance Commissioner, included the following:

2 payroll companies sample CSV FOR EMPLOYERS

3 National_Disaster_Payment-Excel_Template

Copy of Employers_Account_Information

MD’s email sent out for this post | https://bit.ly/2WQFrv3

LATEST RULES: Has Your Company closed due to Covid-19? Claim for your Employees now!